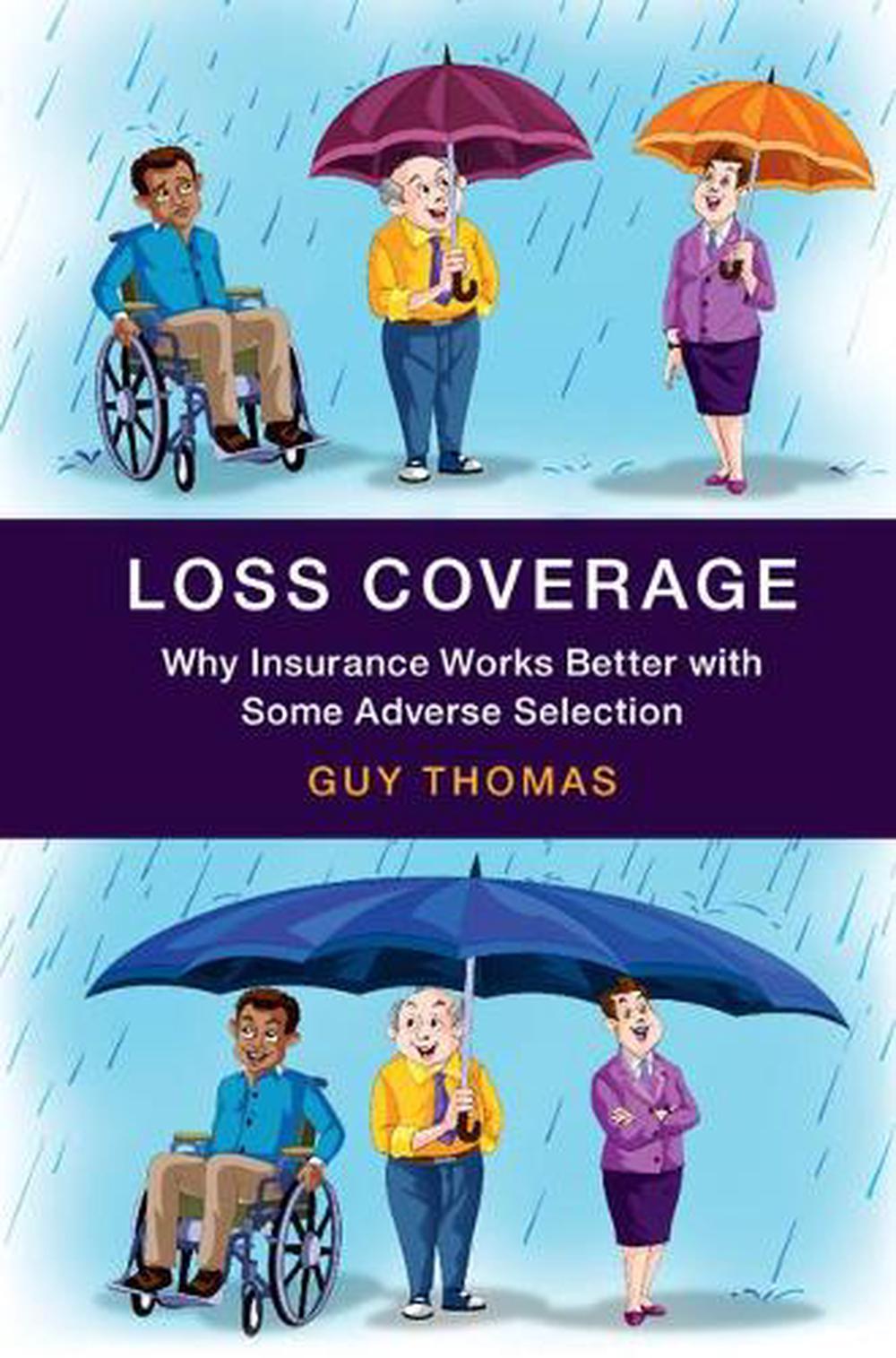

Loss Coverage

why insurance works better with some adverse selection

$184.55

- Hardcover

282 pages

- Release Date

11 May 2017

Summary

Rethinking Adverse Selection: Maximizing Loss Coverage in Insurance

Most academic and policy commentary portrays adverse selection as a critical issue in insurance, one that should always be minimized or avoided. This book challenges that perspective. It argues that the severity of adverse selection is often exaggerated in both insurers’ messaging and economic analyses.

Presenting evidence from various insurance markets, the book demonstrates that adverse selection is freque…

Book Details

| ISBN-13: | 9781107100336 |

|---|---|

| ISBN-10: | 110710033X |

| Author: | Guy Thomas |

| Publisher: | Cambridge University Press |

| Imprint: | Cambridge University Press |

| Format: | Hardcover |

| Number of Pages: | 282 |

| Release Date: | 11 May 2017 |

| Weight: | 520g |

| Dimensions: | 235mm x 157mm x 20mm |

You Can Find This Book In

What They're Saying

Critics Review

‘Guy Thomas challenges the orthodox views held by the insurance industry, actuaries, and economists concerning the problem of adverse selection. He makes his case that a little adverse selection is actually a good thing in a sensible, pragmatic, and compelling manner. His critical insights about the debates on restricting risk classification in insurance should be essential reading for policy makers.’ Michael Hoy, University of Guelph, Canada‘Despite dramatic warnings, insurance companies continue to prosper despite bans on gender rating, genetic testing, racial and other discriminations in setting policy terms. This thought-provoking book explains why. The author makes a convincing case for even tighter regulation of allowable risk classifications to enhance the welfare of society of a whole - especially timely now as 1-in-5 proposers for life insurance are not accepted at standard rates.’ Shane Whelan, FFA, FSAI, Former Managing Editor of the British Actuarial Journal‘Actuaries traditionally see nothing but danger in adverse selection. Guy Thomas, an actuary himself, sees opportunity. Using the concept of loss coverage, Thomas challenges the conventional wisdom of how economists model insurance markets, much of which, he sets out to show, is more myth than reality. Lucidly written and sure to get the reader thinking afresh.’ Angus Macdonald, Heriot Watt University, Scotland‘This is a serious book which challenges some of the conventional thinking of actuaries and economists about adverse selection in insurance, and does so with justification; they would do well to take the author’s views into account. It can also be read with profit by others including insurance managers, academics, and those responsible for public policy.’ David Wilkie, InQA Limited and Heriot Watt University, Scotland‘This is a book that is full of common sense. Thomas provides important and, what will be to many, controversial recommendations to curtail [insurers’] use of certain characteristics of individuals for purposes of differential pricing. … It is important to take seriously the criticisms of both insiders and outsiders to strengthen both the application and development of economics or any other social science. His criticisms are very well thought out.’ Michael Hoy, Annals of Actuarial Science‘In summary, Loss Coverage offers policymakers, academics, professionals, students, and other interested parties useful insight into the ‘problem’ of adverse selection. Thomas employs simple and timely real-world examples to make the concepts of adverse selection, loss coverage, and risk classification more understandable and relevant for policy decisions, offering a path toward mitigating concerns over unfair discrimination while increasing insurance market efficiency.’ William L. Ferguson, Journal of Risk and Insurance

About The Author

Guy Thomas

Guy Thomas is an actuary and investor, and an honorary lecturer at the University of Kent, Canterbury. His academic publications have received prizes from the Institute and Faculty of Actuaries and the International Actuarial Association. He is also the author of Free Capital: How Twelve Private Investors Made Millions in the Stock Market.

Returns

This item is eligible for free returns within 30 days of delivery. See our returns policy for further details.