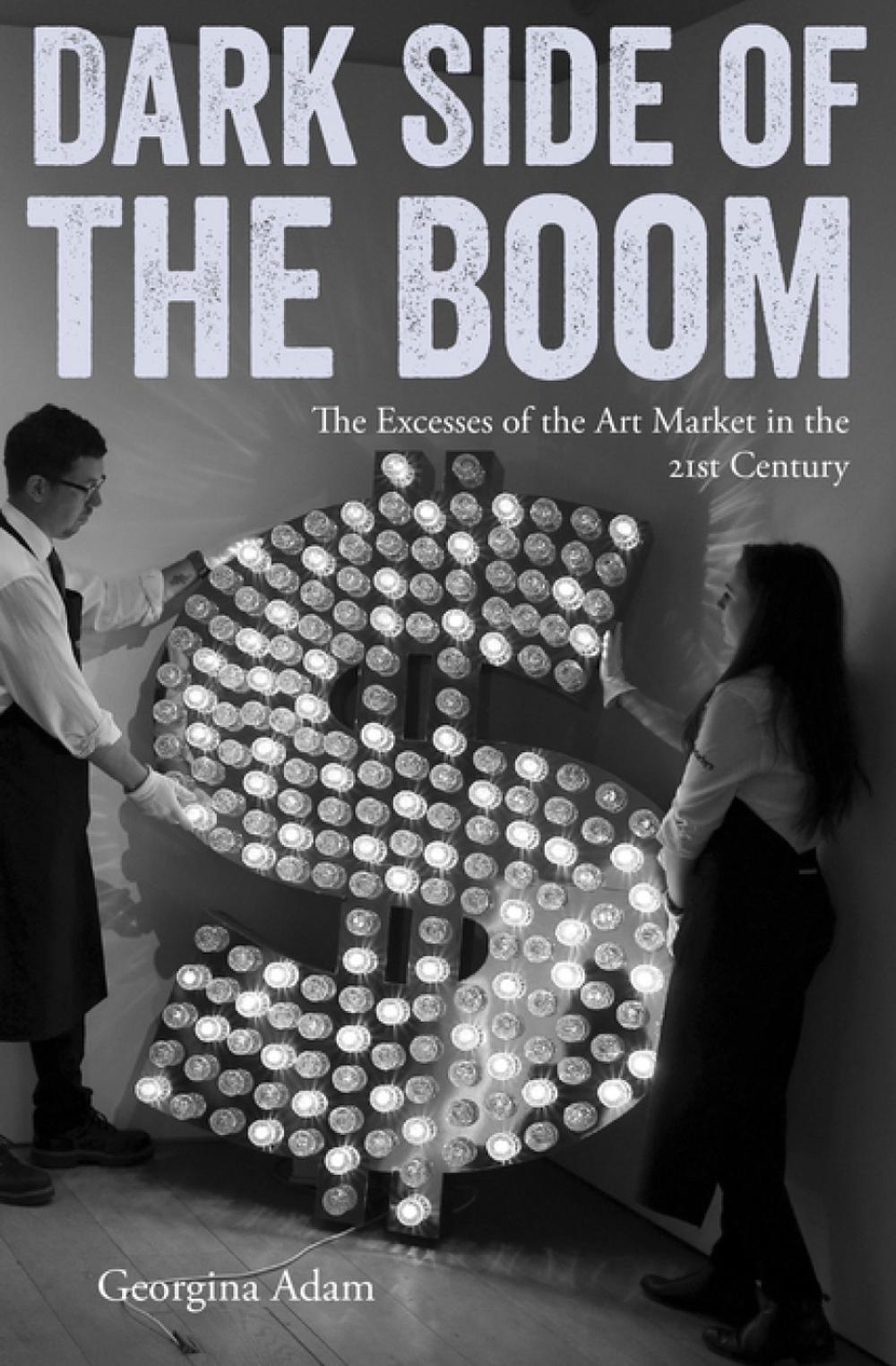

Dark Side of the Boom

The Excesses of the Art Market in the 21st Century

$58.47

- Paperback

232 pages

- Release Date

14 January 2018

Summary

This book lifts the lid on some of the excesses that the 21st-century explosion of the contemporary art market brought in its wake, notably at its very top end. The buying of art as an investment, temptations to forgery, tax evasion, money laundering and pressure to produce more and more art all form part of this story, as do issues over authentication and the impact of the enhanced use of financial instruments on art transactions.

Drawing on a series of revealing interviews with art…

Book Details

| ISBN-13: | 9781848222205 |

|---|---|

| ISBN-10: | 1848222203 |

| Author: | Georgina Adam |

| Publisher: | Lund Humphries Publishers Ltd |

| Imprint: | Lund Humphries Publishers Ltd |

| Format: | Paperback |

| Number of Pages: | 232 |

| Release Date: | 14 January 2018 |

| Weight: | 450g |

| Dimensions: | 234mm x 153mm |

You Can Find This Book In

What They're Saying

Critics Review

‘A “must-read” for anyone with an interest in the relationship between art and money.’ Daily Telegraph

About The Author

Georgina Adam

Georgina Adam is a journalist and author who has covered the global art market for over 30 years. She is a contributor to the Financial Times and The Art Newspaper, where she was Art Market Editor from 2000 to 2008 and is now Editor at Large. She is the author of Big Bucks: The Explosion of the Art Market in the 21st Century (Lund Humphries, 2014).

Returns

This item is eligible for free returns within 30 days of delivery. See our returns policy for further details.